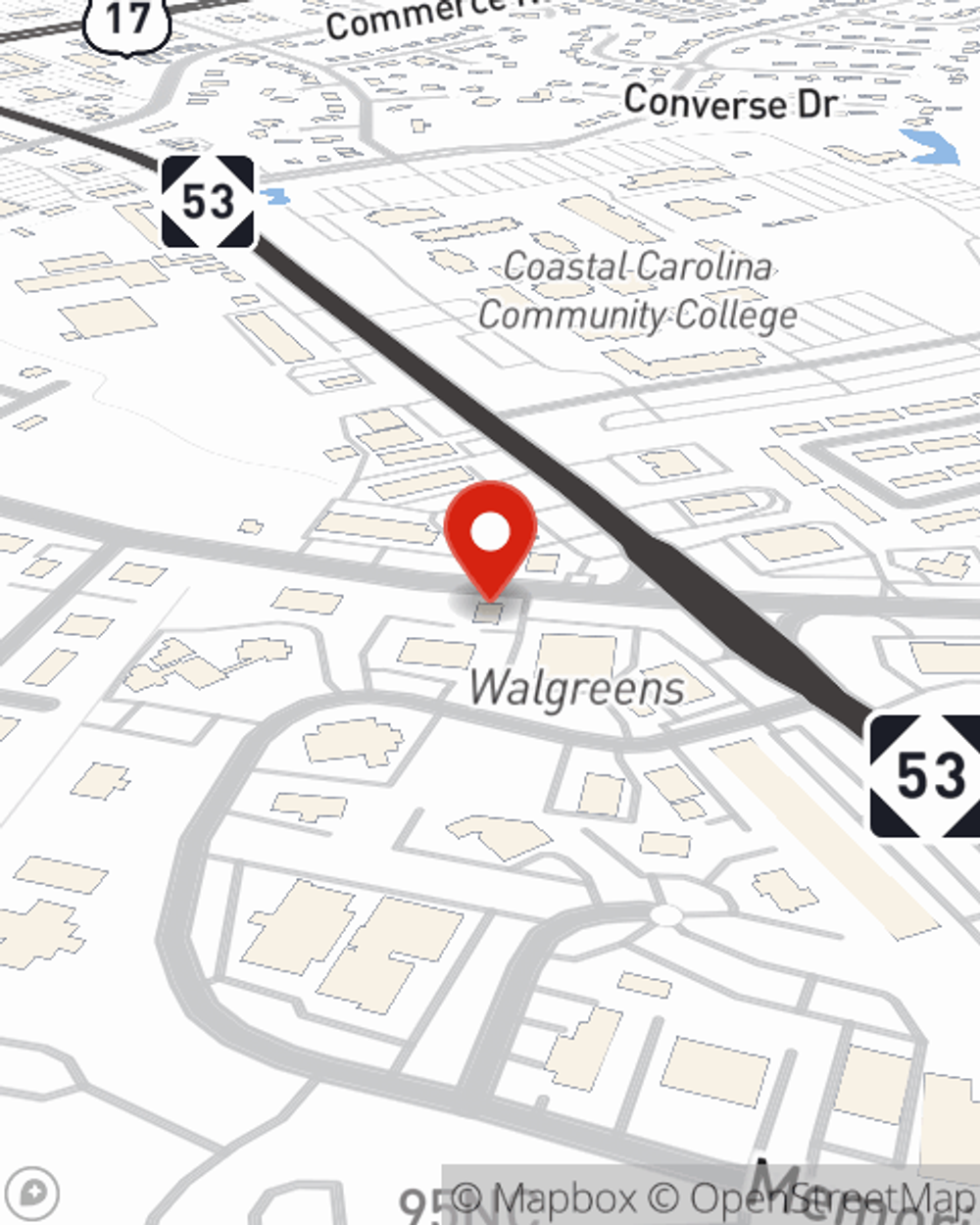

Life Insurance in and around Jacksonville

Get insured for what matters to you

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Protect Those You Love Most

Do you know what funerals cost these days? Most people aren't aware that the standard cost of a funeral nowadays is $8,500. That’s a heavy burden to carry when they are grieving a loss. If the people you love cannot cover those costs, they may fall on hard times as a result of your passing. With a life insurance policy from State Farm, your family can thrive, even without your income. Whether it pays off debts, keeps paying for your home or pays for college, the life insurance you choose can be there when it’s needed most by your loved ones.

Get insured for what matters to you

Life won't wait. Neither should you.

Life Insurance You Can Trust

Some of your options with State Farm include level or flexible payments with coverage designed to last a lifetime or coverage for a specific number of years. But these options aren't the only reason to choose State Farm. Agent David Hull's compassionate customer service is what makes David Hull a great asset in helping you settle upon the right policy.

Interested in learning more about what State Farm can do for you? Visit agent David Hull today to get to know your specific Life insurance options.

Have More Questions About Life Insurance?

Call David at (910) 455-0440 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.